Digital Financial Information NetworkLet's Track The Market Collapse |

|

Income Property Will Do Worse Than Housing

|

Real Estate Observations and Comments

| Why Are Home Prices Weak | Excess Office Space |

I have been part of housing cycles since

the mid 70s when rental information was a challenge. and price discovery was

very cumbersome.

A Focus on Apartments

We will focus on apartments for our demonstration. The mathematics are the same but the risk differs. Everyone needs a place to live but retail, industrial and office buildings are more complex. The economics and risk are very different. Having said that, I have known people that favored one type of income property and had no interest in others IE: one likes Industrial and another may prefer Office.

Inflation is an important factor in rents today. The graph on the left illustrates how rents moved with inflation in the high inflation 1970s. How about the recent spike in rates? I expect rents to go negative in the near future before they resume normal increases.

Another risk for income property loans is lenders. Early in my career few banks made apartment loans. The owner of LaJolla Bank started the bank to specialize in apartment lending. Their are more lenders today but in a bad market loans are difficult to secure. Loan underwriters need to factor in lower rent expectations and most likely more vacancies. Smart apartment owners will lower rents to maintain occupancy.

Income property value is a function of Net Operating Income. The interest rate impacts the capitalization rate and the combination of the two, in my opinion, have the biggest impact on value. When interest rates go up, expenses increase and so do Cap Rates.

See the example below.

A Focus on Apartments

We will focus on apartments for our demonstration. The mathematics are the same but the risk differs. Everyone needs a place to live but retail, industrial and office buildings are more complex. The economics and risk are very different. Having said that, I have known people that favored one type of income property and had no interest in others IE: one likes Industrial and another may prefer Office.

Inflation is an important factor in rents today. The graph on the left illustrates how rents moved with inflation in the high inflation 1970s. How about the recent spike in rates? I expect rents to go negative in the near future before they resume normal increases.

Another risk for income property loans is lenders. Early in my career few banks made apartment loans. The owner of LaJolla Bank started the bank to specialize in apartment lending. Their are more lenders today but in a bad market loans are difficult to secure. Loan underwriters need to factor in lower rent expectations and most likely more vacancies. Smart apartment owners will lower rents to maintain occupancy.

Income property value is a function of Net Operating Income. The interest rate impacts the capitalization rate and the combination of the two, in my opinion, have the biggest impact on value. When interest rates go up, expenses increase and so do Cap Rates.

See the example below.

|

Income Property is all about Net Operating Income (NOI) (Gross Income Less All Expense) |

| Income Property Valuation Fundamentals | |||

| Monthly / Rate | Annual | ||

| Rent ($2,400 Mo Rent) | $2,400 | $576,000 | |

| Expenses | 45% | $259,200 | |

| Net Operating Income (NOI) | $316,800 | ||

| Cap Rate - Late 2021 or Early 2022 | 4% | 4% | |

| Value at a 4% Cap Rate | $7,920,000 | ||

| What if Cap rate is 10% as it has been for most of my career? |

10% | $3,168,000 | |

| Potential Loss In Value | $4,752,000 | ||

PRESS/NEWS

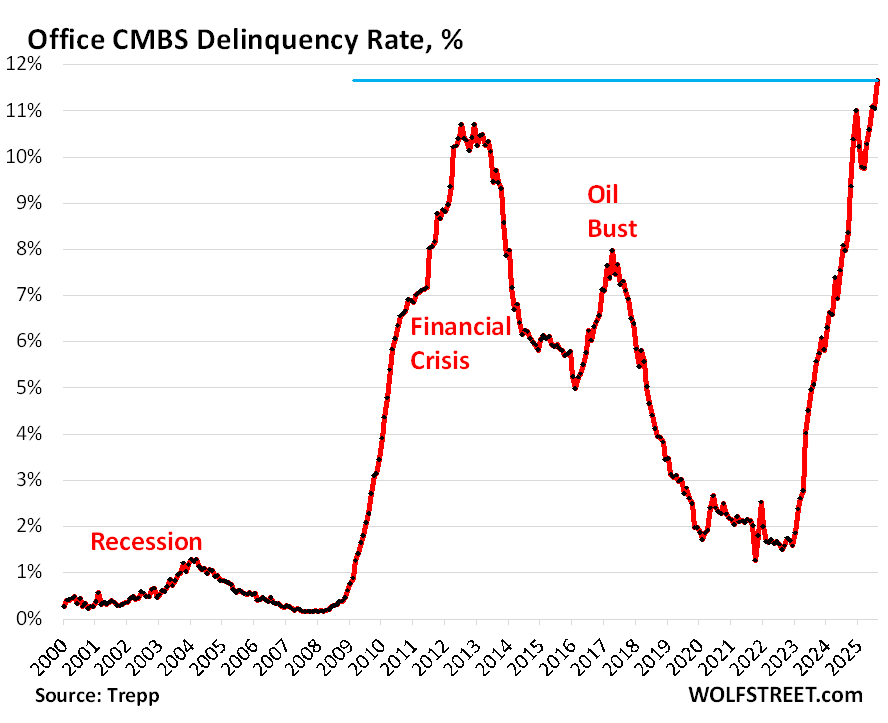

Office CMBS Delinquency Rate Spikes to Record 11.7%, Much Worse

than Financial Crisis Peak. Multifamily Delinquencies also Spike

The

delinquency rate of office mortgages that have been securitized into

commercial mortgage-backed securities (CMBS) spiked to 11.7% in

August, the worst ever, a full percentage point above even the peak

meltdown rate of the Financial Crisis (10.7%), according to data by

Trepp , which tracks and analyzes CMBS.

The

delinquency rate of office mortgages that have been securitized into

commercial mortgage-backed securities (CMBS) spiked to 11.7% in

August, the worst ever, a full percentage point above even the peak

meltdown rate of the Financial Crisis (10.7%), according to data by

Trepp , which tracks and analyzes CMBS.

by Wolf Richter • Sept 1, 2025 • https://wolfstreet.com/2025/09/01/office-cmbs-delinquency-rate-spikes-to-record-11-7-much-worse-than-financial-crisis-peak-multifamily-delinquencies-also-spike/

Banks Getting Rid of Bad CRE Loans: Dutch Megabank ING Dumps One

of the Largest Office Properties in San Francisco

by Wolf Richter • Jun 5, 2025 • Banks Getting Rid of Bad CRE Loans: Dutch Megabank ING Dumps One of the Largest Office Properties in San Francisco | Wolf Street

After CRE Office Market Repriced at 70% Off in San Francisco,

Sales Revive. Leasing Jumps amid 35% Vacancy Rates and 21% Drop

in Asking Rents by Wolf Richter • May 6, 2025

Another San Francisco office building sold for a discount of close to 70% from acquisition cost, amid a slew of deals happening in that range, indicating that the repricing of CRE properties was effective in jarring the market loose, and allowing new investors to come in at a much lower cost-basis and do something with those older buildings, and invest in them, including converting a few of them to residential properties.

After CRE Office Market Repriced at 70% Off in San Francisco, Sales Revive. Leasing Jumps amid 35% Vacancy Rates and 21% Drop in Asking Rents | Wolf Street

Now the Multifamily CMBS Delinquency Rate Begins to Spike, while Office Delinquencies Re-Spike to Financial Crisis Peak

Delinquencies of office mortgages that were securitized into commercial mortgage-backed securities (CMBS) have been in the red-hot zone since mid-2023 and in December 2024 hit 11.0%, surpassing even the debt-meltdown during the Financial Crisis. Then, during the first three months of 2025, the delinquency rate backed off some, but in April re-spiked by 52 basis points to 10.3%, according to data by Trepp today, which tracks and analyzes CMBS.

by Wolf Richter • May 1, 2025 Now the Multifamily CMBS Delinquency Rate Begins to Spike, while Office Delinquencies Re-Spike to Financial Crisis Peak | Wolf Street

Another San Francisco office building sold for a discount of close to 70% from acquisition cost, amid a slew of deals happening in that range, indicating that the repricing of CRE properties was effective in jarring the market loose, and allowing new investors to come in at a much lower cost-basis and do something with those older buildings, and invest in them, including converting a few of them to residential properties.

After CRE Office Market Repriced at 70% Off in San Francisco, Sales Revive. Leasing Jumps amid 35% Vacancy Rates and 21% Drop in Asking Rents | Wolf Street

Now the Multifamily CMBS Delinquency Rate Begins to Spike, while Office Delinquencies Re-Spike to Financial Crisis Peak

Delinquencies of office mortgages that were securitized into commercial mortgage-backed securities (CMBS) have been in the red-hot zone since mid-2023 and in December 2024 hit 11.0%, surpassing even the debt-meltdown during the Financial Crisis. Then, during the first three months of 2025, the delinquency rate backed off some, but in April re-spiked by 52 basis points to 10.3%, according to data by Trepp today, which tracks and analyzes CMBS.

by Wolf Richter • May 1, 2025 Now the Multifamily CMBS Delinquency Rate Begins to Spike, while Office Delinquencies Re-Spike to Financial Crisis Peak | Wolf Street

Lenders seize uptown office tower for 31% its assessed value

Former owner Oaktree, known for distress buys, let the building go, signaling trouble for Charlotte’s aging office properties. Oaktree and Trinity purchased the tower built in 1975 for $133.5 million in 2018 but fell behind on loan payments in July 2023.

The sale marks a sharp retreat for Oaktree, a global private equity firm known for distressed real estate bets — and could signal further trouble for Charlotte’s older office properties.

Lenders Seize Uptown Charlotte Office Tower After Foreclosure

Get ready for a big downturn — America's 'office apocalypse' is even worse than expected

Less foot traffic, less public-transit use, and more shuttered businesses have caused many downtowns to feel more like ghost townsEven 2 1/2 years later, most city downtowns aren't back to where they were prepandemic.

Story by insider@insider.com (Emil Skandul) • Dec 6, 2022 https://www.msn.com/en-us/money/realestate/get-ready-for-a-big-downturn-americas-office-apocalypse-is-even-worse-than-expected/ar-AA14Y5TI

Bloomberg, By Natalie Wong, John Gittelsohn and Noah Buhayar https://www.bloomberg.com/graphics/2022-remote-work-is-killing-manhattan-commercial-real-estate-market/?leadSource=uverify%20wall

San Francisco Braces for Epic Commercial Real Estate Crash

There’s currently more than 25 million square feet of commercial space available for lease or sublease in the city, the equivalent of about 35 Transamerica Pyramids sitting empty.

And a recent report from the Urban Displacement Project ranked the city’s downtown recovery as dead last among more than 60 cities across North America. by Kevin Truong Research by Noah Baustin Contributors Annie Gaus Updated at Sep. 06, 2022 • 12:33pm Published Sep. 06, 2022 • 5:00am https://sfstandard.com/business/san-francisco-braces-for-epic-commercial-real-estate-crash/

Three Hotels Approaching Foreclosure in the Heart of Portland Offer a Warning to City Leaders

“The banks are trying to keep these properties off the foreclosure list, because why would you want to take something back that you know is a bloody mess? But eventually they have to.” By Sophie Peel September 07, 2022 at 5:30 am PDT https://www.wweek.com/news/2022/09/07/three-hotels-approaching-foreclosure-in-the-heart-of-portland-offer-a-warning-to-city-leaders/

|

The Mortgage Rate in America Every Year Since 1972: |

Three Hotels Approaching Foreclosure in the Heart of Portland Offer a Warning to City Leaders

“The banks are trying to keep these properties off the foreclosure list, because why would you want to take something back that you know is a bloody mess? But eventually they have to.” By Sophie Peel September 07, 2022 at 5:30 am PDT https://www.wweek.com/news/2022/09/07/three-hotels-approaching-foreclosure-in-the-heart-of-portland-offer-a-warning-to-city-leaders/

|

Back to Search Contact: Gary Lewis Evans; GLE@DFIN.com; 858.210.0486 Copyright Home  |