Digital Financial Information NetworkLet's Track The Market Collapse |

|

|

"Home Prices Are Going Lower" -

Published

November 2021 Gary Lewis Evans - In August, I Sold a home in LA in Anticipation

Commercial Property Will Do Worse

Real Estate Observations, News and Comments |

Banking Executive - FinTech Banking Pioneer |

Skilled Receiver

I have been part of housing cycles since the

mid 70s when home price discovery was near imposable for lenders. I became a

banker in 1971, and pioneered Internet banking in 1994. In 1971 real estate

appraising was cumbersome at best and was a skill profession. All history,

if any, was on paper. In the late 80s, the rapidly changing world of technology was

emerging with profound implications for every aspect of life, personal and

professional. I have seen historic real estate price data move from

difficult to find to being easily accessible to everyone.

I have been part of housing cycles since the

mid 70s when home price discovery was near imposable for lenders. I became a

banker in 1971, and pioneered Internet banking in 1994. In 1971 real estate

appraising was cumbersome at best and was a skill profession. All history,

if any, was on paper. In the late 80s, the rapidly changing world of technology was

emerging with profound implications for every aspect of life, personal and

professional. I have seen historic real estate price data move from

difficult to find to being easily accessible to everyone. I have seen many housing cycles and always performed well. In one cycle I purchased a home for about 50% of its high price. I believe that we are at a cycle peak at this time. March/April 2022.

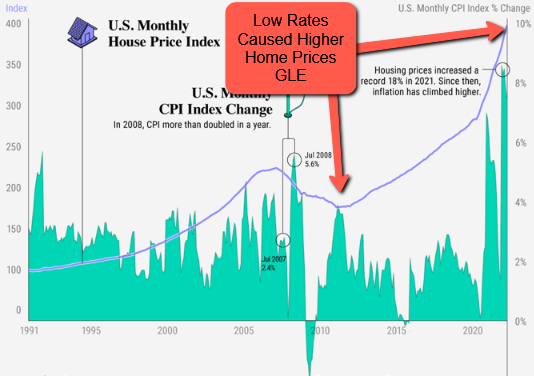

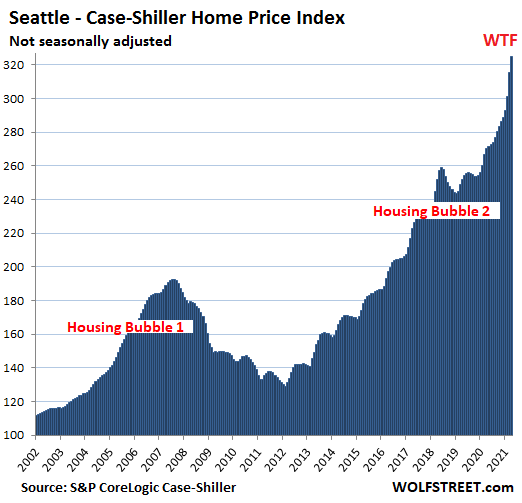

The 2021/22 Cycle is unique. The historic low interest rates is an anomaly that allowed people to qualify for mortgage loans at greater relative levels than ever before. In other words, lower interest rates supported higher home prices. In financial terms, lower interest rates leads to a lower risk free rate and lower cap rates. Lower Cap rates raises asset values. Real estate is not immune from economics.

This DFIN example below demonstrates how an August 2021 $700,000 home sale in Los Angelous, CA may trap owners into the home because of the future price drop. When interest rates go back to 8% the recent $700,000 purchase may result in a loss in value of more than $200,000. Why are we so confident of such a loss? It is the math and payment affordability. When interest rates increase asset prices drop and when interest rates go down asset values go up. The interest rate is a key element for investor Cap Rates.

|

St. Louis Federal

Reserve Bank 30 Year Mortgage Rates |

FHLMC

Primary Mortgage Market Survey® |

HOME DYNAMICS Consumers typically purchase the most expensive home that they can afford. In other words, the purchase is payment driven and the payment is based upon the interest rates. The lower the rate the more buyers can afford to pay. In 2022 Interest rates are going to increase and home prices will come Down. I have been a real estate lender for over 40 years including about 30 years as a bank president. I have successfully worked through every boom and bust since the early 1970s. This includes the high mortgage rates of 14%+ in the early 1980s and the recent mortgage rate lows of 2.50%. Table A column 1 below Illustrates the real home sale in late 2021 and section B column 3 illustrates home pricing requirements if mortgage rates were 8%. A reasonable home loan payment would require a price $230,000 lower when rates move from 3.14% to 8%.

The demographics of the home sold is a middle to the lower-middle-income community of Winnetka CA. Example 1 in Table A represents that the home sold for a little over $700,000, the down payment was $140,000. The monthly payment was $3,201 which is 35% of the minimum monthly income requirement of $9,150 and the annual income required is $109,800. This is real. What if the mortgage rate was 8% instead of 3.15%? Example 2 in Table A illustrates that to be affordable the original $700,000 purchase price the buyer would need to earn $168,000 per year to cover the 35% requirement for loan approval. As is, the 8% payment would be $4,904 which is over 50% of the buyers gross monthly income. If the original buyer wanted to purchase the home in an 8% world, how much should the buyer offer? In other words, with all else being equal, what would the home need to sell for to be affordable to a new buyer with the same income characteristics as the 2021 original buyer? See Table B Colum 3. The home would need to sell for approximately $470,000. This is a loss of approximately $230,000. |

| Table A Original $700,00 Purchase | Table B Lower Purchase Price Because of Higher Mortgage Interest Rates | ||

| EXAMPLE | 1 - Real Sale Base Case | 2 - Same as 1 But 8% Rate Characteristics | 3 - Assume Borrower is the Same - How Much Can Borrower Pay For the Home at an 8% Mortgage Rate |

| Aug 2021 Sale | What is Payment if Rate Was 8% | What Could a Current Buyer Afford if Income Was the Same and Rates Were 8%? | |

| Purchase Price | $700,000 Because Rate is so Low |

$700,000 What if Rate is 8% |

$470,000 Max Loan at 8% and Current Income |

| 20% Down Payment | $140,000 | $94,000 Paid Less so Lower Down Payment |

|

| Loan Amount | $560,000 | $376,000 | |

| Term | 30 Years | ||

| Rate | 3.15% | 8% Buyer Could Not Purchase the Home at 8% |

8% A Person That Would Want to Live in This Neighborhood Could Not Afford to Purchase When Rates are Higher. |

| FICO | 740+ | ||

| Monthly Taxes

1.25% of Price Div. By 12 |

$729 | $495 | |

| Payment | $3,201 | $3,349 | |

| Required

Monthly Income at 35% Max Payment to Income |

$9,150 | $14,000 | $9,568 |

| Annual Income | $109,800 | $168,000 | $115,000 |

| Payment to

Income Ratio |

35% | 54% | Approx. 35% |

| PRESS/NEWS |

Prices of New Houses Drop, Sales Drop, Supply Jumps

Homebuilders are trying all kinds of stuff to get sales going in this environment of 7%-plus mortgage rates, including cutting prices, building at lower price points, piling on incentives (such as free upgrades), and the biggie, buying down mortgage rates, which can get expensive for builders. Neither incentives nor mortgage-rate buydowns are reflected in the prices of homes sold, and yet prices have dropped, and sales have dropped too below 2019 levels, and inventory increased, and months supply jumped. By Wolf Richter for WOLF STREET.

https://wolfstreet.com/2023/09/26/prices-of-new-houses-drop-sales-drop-inventory-supply-jump/

As US home prices decline, number of buyers with underwater mortgages swells

An alarming number of new homeowners are discovering they owe more on their mortgage than their home is worth as surging interest rates send housing prices spiraling down. By Megan Henney FOXBusiness December 13, 2022 12:37pm EST

https://www.foxbusiness.com/economy/us-home-prices-decline-number-buyers-underwater-mortgages-swells

Homebuilders say they’re on the edge of a steeper downturn as buyers pull back

Housing starts for single-family homes dropped nearly 19% year over year in September, according to the U.S. Census. Building permits, which are an indicator of future construction, fell 17%. MON, OCT 31 20222:12 PM EDT

https://www.cnbc.com/2022/10/31/homebuilders-say-steeper-downturn-is-coming-as-buyers-pull-back.html

More homebuyers look to ARMs to finance their home… CNBC

CNBC’s Diana Olick joins Shep Smith to report on rising mortgage rates, which have hit their highest level in 20 years, and the impact it’s having on homebuyers. Thu, OCT 20 2022 7:31 PM EDT

https://www.youtube.com/watch?v=9_70uRY_QX4

These 210 bubbly housing markets could crash 25% to 30%—Moody’s again slashes its home price forecast

You don’t need a Ph.D. in economics from the University of Chicago to understand that 7% mortgage rates are a threat to the U.S. housing market. BYLANCE LAMBERT October 5, 2022 at 7:02 AM PDT

https://fortune.com/2022/10/05/housing-markets-at-risk-of-25-to-30-percent-home-price-crash-moodys/

Think mortgage rates are high now? Homebuyers in the 1980s were paying 19%

Strait recalled one couple who were actually relieved when they locked in a 30-year fixed-rate mortgage at 19% in September 1981. By Anna Bahney, CNN Business Published 2:43 PM EDT, Thu September 29, 2022

I took out an adjustable rate loan at about that time and the teaser rate was about 14%. At that time people acted like rates would never come down. I opened a 12% IRA CD at that time.

https://www.cnn.com/2022/09/29/homes/1980s-mortgage-rates-home-affordability/index.html

Three Hotels Approaching Foreclosure in the Heart of Portland Offer a Warning to City Leaders

“The banks are trying to keep these properties off the foreclosure list, because why would you want to take something back that you know is a bloody mess? But eventually they have to.” By Sophie Peel September 07, 2022 at 5:30 am PDT

https://www.wweek.com/news/2022/09/07/three-hotels-approaching-foreclosure-in-the-heart-of-portland-offer-a-warning-to-city-leaders/

‘Poison’ Ivy Zelman—the analyst who predicted the 2008 housing bust—sees U.S. home prices falling in both 2023 and 2024. Here’s how much

When Toll Brothers CEO Bob Toll tried to say the housing market had bottomed out in 2006, Zelman famously quipped back, “Which Kool-Aid are you drinking, because I want some.” Of course, Zelman’s housing-bust fears proved more than correct, and all those at the time who thought demographics would continue to propel the aughts’ home prices forward were proved dead wrong. BYLANCE LAMBERT September 6, 2022 at 6:30 AM PDT

https://fortune.com/2022/09/06/home-price-forecast-prediction-2023-2024-ivy-zelman-housing-market/

Daily

Mail: US housing market is in 'much worse shape' than Fed is letting on,

economist warns :

The U.S. housing market is in significantly

worse shape than the Federal Reserve is saying, a top economist has

warned - and prices will soon fall sharply. Ian Shepherdson, chief

economist at Pantheon Macroeconomics, said that the outlook for housing

sales is even more grim than the Fed has said, and the 'worst is yet to

come' for home prices. He tweeted on Tuesday that he had been 'bearish

as hell about housing for months' - meaning that he predicted a

significant slump in the market. August 25, 2022 Daily Mail

Daily

Mail: US housing market is in 'much worse shape' than Fed is letting on,

economist warns :

The U.S. housing market is in significantly

worse shape than the Federal Reserve is saying, a top economist has

warned - and prices will soon fall sharply. Ian Shepherdson, chief

economist at Pantheon Macroeconomics, said that the outlook for housing

sales is even more grim than the Fed has said, and the 'worst is yet to

come' for home prices. He tweeted on Tuesday that he had been 'bearish

as hell about housing for months' - meaning that he predicted a

significant slump in the market. August 25, 2022 Daily Mailhttps://www.dailymail.co.uk/news/article-11144025/US-housing-market-worse-shape-Fed-letting-economist-warns.html

|

Home price appreciation will normalize. "What 5 economists and real estate pros predict will happen to home prices in 2022 March 14, 2022:Sone predict double digit growth. Indeed, a report in January from Zillow noted that home values were expected to grow 16.4% between December 2021 and December 2022; Goldman Sachs, in October, forecast that home prices would rise 16% through 2022. Fannie Mae says home prices will climb 11.2% throughout this year, followed by a more modest increase in 2023. https://www.marketwatch.com/picks/home-price-appreciation-will-normalize-what-5-economists-and-real-estate-pros-predict-will-happen-to-home-prices-in-2022-01646940841 |

|

Falling home prices? It’s only likely in these 13 housing markets, says

Core Logic BY LANCE LAMBERT March 17, 2022

:

Based upon the analysis above we disagree with Core Logic. "The housing market isn't just running hot—it's running red-hot." Plus every single major forecast model shows home prices rising nationally this year". https://fortune.com/2022/03/17/home-prices-drop-housing-markets-california-michigan-massachusetts-corelogic/ |

|

Mortgage rates jump above 4% — prompting borrowers to return to a staple

of the housing bubble MARCH 21, 2022 :

|

|

Yahoo Finance Barbara Corcoran: Homebuyers ‘should move faster’ amid

soaring prices MARCH 23, 2022 :

https://finance.yahoo.com/news/barbara-corcoran-homebuyers-should-move-faster-amid-soaring-prices-141530835.html#:~:text=%22You%20should%20move%20faster%20because,'ve%20been%20dreaming%20about.%22 |

|

California's real estate market continues to be extremely competitive

March 16, 2022 :

FOX 11's Hailey Winslow was in Mission Viejo as the demand for homes remain extremely high across Orange County. https://www.youtube.com/watch?v=vm1mOprNjyQ |

|

Mortgage rate soars closer to 5% in its second huge jump this week PUBLISHED FRI, MAR 25 2022:

https://www.cnbc.com/2022/03/25/mortgage-rate-soars-closer-to-5percent-in-its-second-huge-jump-this-week.html |

|

House prices are going up. Here’s when you should increase your budget, and when to stick to your original price MAR 27 2022:

|

|

‘Home price appreciation will normalize.’ What 5 economists and real estate pros predict will happen to home prices in 2022 - MAR 14, 2022: In 2021, home prices skyrocketed nearly 19%, according to the S&P Core Logic Case-Shiller home price index. And pros say we’re in for another year of price growth. https://www.marketwatch.com/picks/home-price-appreciation-will-normalize-what-5-economists-and-real-estate-pros-predict-will-happen-to-home-prices-in-2022-01646940841 |

|

The California cities where home prices have more than tripled since

2000 April 3, 2022:

https://www.newsbreak.com/news/2560700417853/the-california-cities-where-home-prices-have-more-than-tripled-since-2000?s=oldSite&ss=dmg_local_email_bucket_12.web2_fromweb |

|

The Mortgage Rate in America Every Year Since 1972 April 3, 2022:

|

|

A ‘perfect storm’ is driving up home prices, expert says April 2, 2022:

|

|

We’re not in a housing bubble, say Zillow economists May 13,2022:

|

|

Home listings suddenly jump as sellers worry they may miss out on the red-hot housing market May

26, 2022:

|

|

Back to Search Contact: Gary Lewis Evans; GLE@DFIN.com; 858.210.0486 LinkedIn Bio; https://www.linkedin.com/in/garyevans/ Copyright Home  |