|

Digital Financial

Information Network The Executive Desktop Reference Center |

|

Economic and Financial Graphics

| Live Graphs - Static Graphs Below | |||

|

St. Louis Federal

Reserve Bank 30 Year Mortgage Rates |

FHLMC

Primary Mortgage Market Survey® |

||

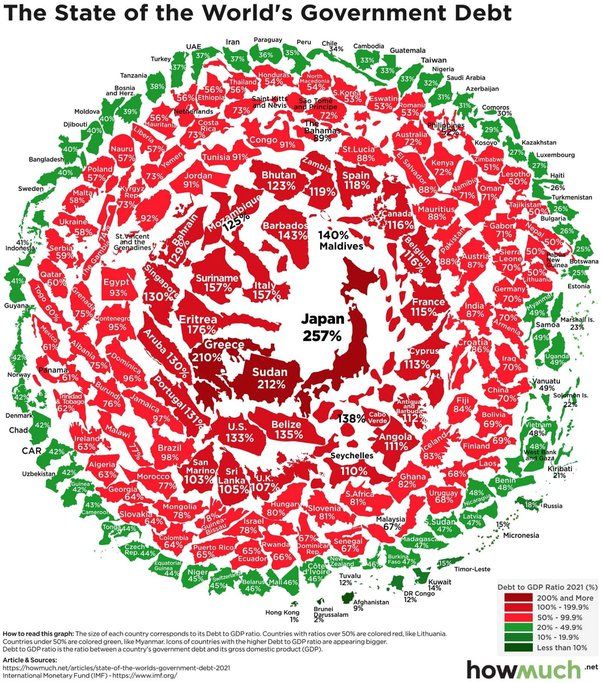

Global Country Debt

|

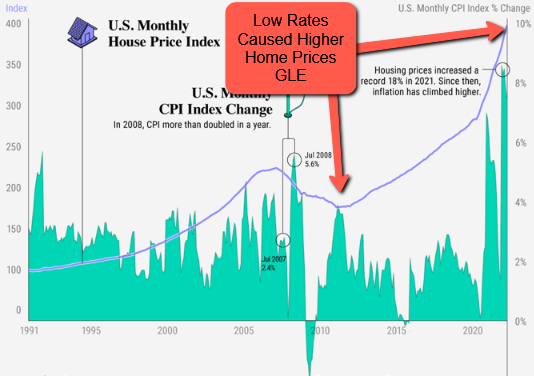

Inflation Rates and Mortgage Rates Were Out of Sync

Housing prices skyrocketed during a period of low inflation and more important historic low mortgage rates. We are in a housing correction now. As rates increase housing affordability go down and that results in lower home prices. August 2022 |

The Mortgage Bankers Association reported in March 2022 that the medium mortgage application payment jumped to $1,736. This is caused by both home prices and interest rate increases.

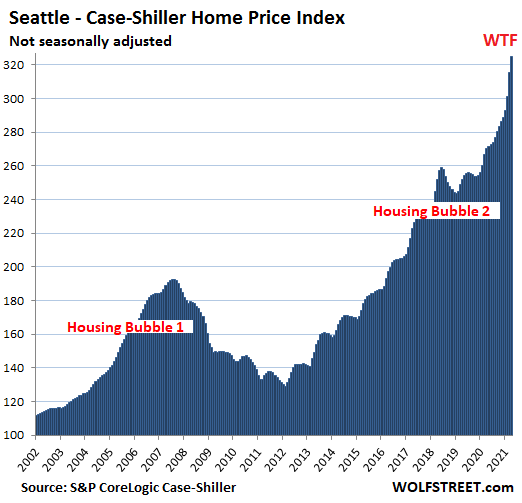

The 2021 - 2022 US Housing

Bubble as

Documented by Case-Shiller Index

|

Seattle Graphic Above - Mortgage Calculator

DFIN expect to see a significant home price correction. See real estate Tab. for analysis.

DFIN demonstrates how a August 2021 $700,000 home sale in Los Angelous, CA may trap owners into the home. When rates go back to 8% the $700,000 purchase may result in a loss in value of more than $200,000.

German PPI Up 25% in January

2022

Shutting Down the Economy and Printing Money Will Have Long Term

Consequences

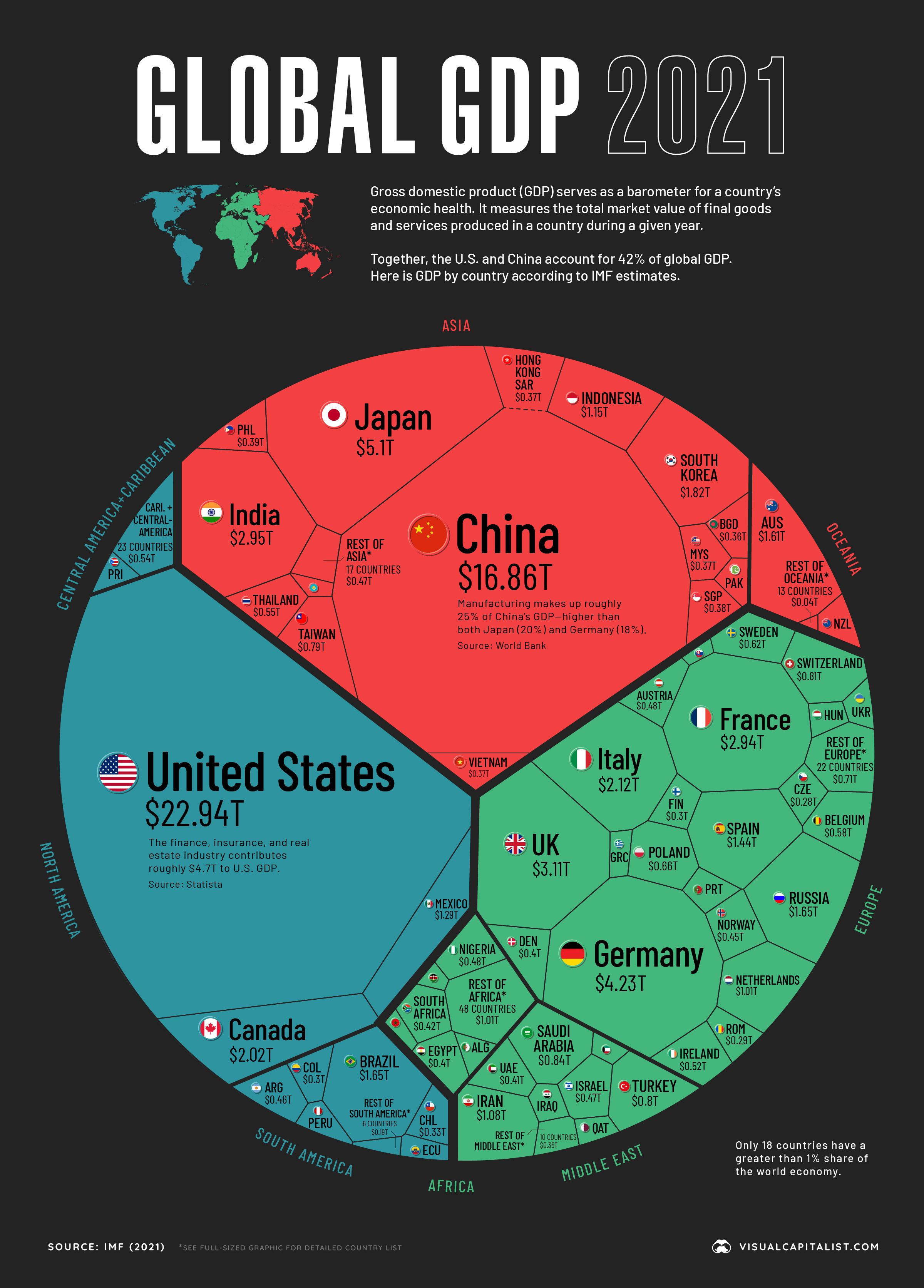

Global Debt Versus Each

Countries GDP

(Debt to Gross National Product)

February 2022

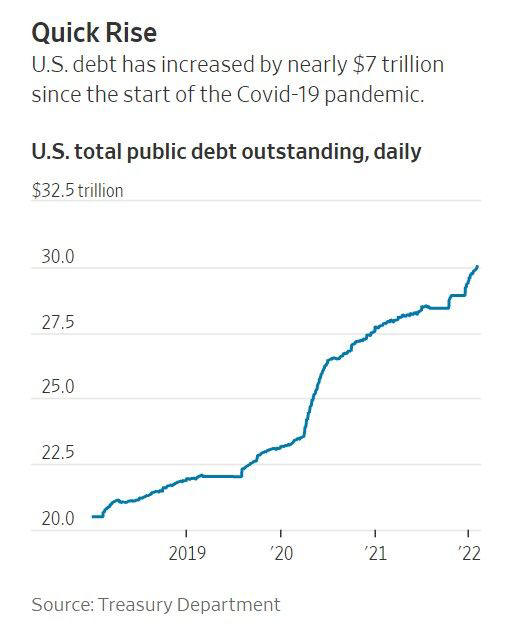

US National Debt Exceeds

Thirty (30) Trillion for First Time

February 2022

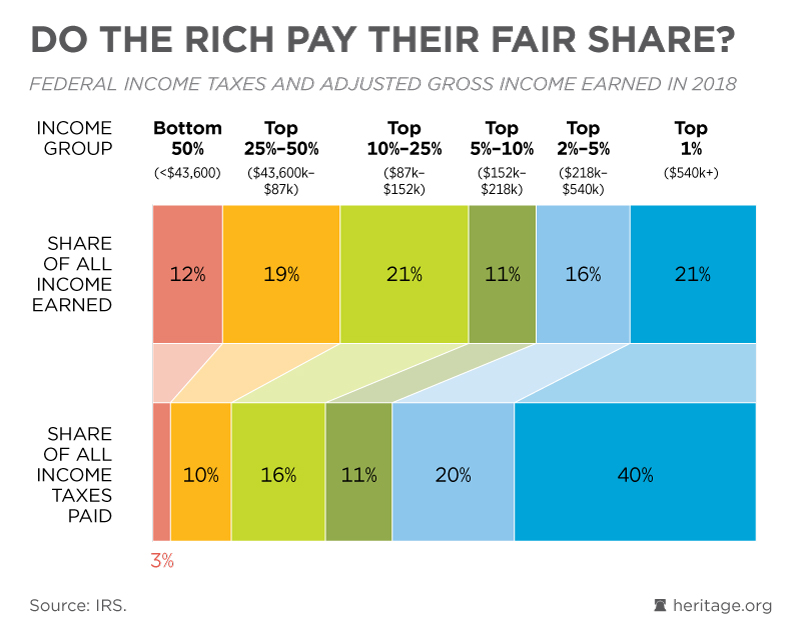

Do The Rich Pay Their Fair Share of Taxes?

|

I couldn't find a chart like this from the 99% but I count on them to refute this data if it is not accurate. They can't refute the data. So if the top 1% earns 21% of income and pays 40% of the tax isn't that enough? The top 10% of earners pay 71% of all federal taxes. I believe it is OK if the bottom 50% of the population only pays 3% or Less.

In Kingdoms and Dictatorships the top 10% would probably have little tax because they were friends of the Kings or ruling class.

|

June 2021 Comment on The Economy

Some of Us Are Very Concerned

International Economy, provides insights on economic and policy issues

The Federal Reserve has increase the money supply by

over 30% in the last year. This is the greatest increase in the history of

our nation.

DFIN believe that the excessive simulative fiscal policies

(government spending) and simulative monetary policy does not bode well for our

near term economy.

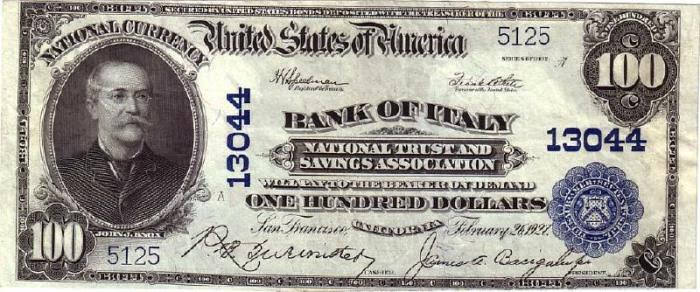

Their Was a Time When Banks Printed

Money

Unlike Crypto Currency Today the

banks typically had hard assets

securing the currency issued.

Think of this money as an IOU. The image below is a Bank of Italy $100 bill. Printed in 1927 just before the banks name was changed to Bank of America. I would argue that this money had greater buying power and was more secure than a US $100 bill today.

Copyright 1996 - 2022

Please Read This Important Copyright Notice

Founded 1996 San Diego, California, USA

GLE@DFIN.COM