Non-Fungible Domain Assets, NFTs, Blockchain

|

|

A Good 4 Minute Video Describing Hockey Stick Sales Boost From a New Domain |

First Time Sold In 25 Years DFIN.com

| Non-Fungible Digital Assets For Sale | |

|

Premium Domains and Two Pre-packaged Marketplaces For Sale or Lease

Please email The Digital Financier GLE@DFIN.COM with questions |

Following is a status report on crypto, non-fungible assets, (domains and NFTs) with

comments on the need, plus a few documented transactions.

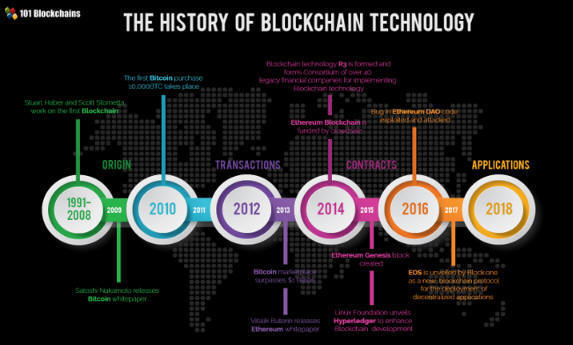

Blockchain as used to date has not impressed me with the business models. Bitcoin may be the oldest modern example of Blockchain.This great technology has been used to create a speculative bubble. I call Bitcoin "unstable value currency," Bitcoin and similar experimental activity is to be expected when a life changing new direction in business is being launched and tested. Similar excesses, misdirection and eventual failures happened with other revolutionary innovations like trains, autos and the Internet before they stabilized. The digital economy is dependent on Internet technology and modern delivery services. For the first time in history, individuals can buy and sell globally and directly with manufacturers and individuals. Low cost digital payments will be developed to facilitate the sales. Only government regulation will stop this global commerce momentum. The global market gives companies a comparative advantage to sell goods and services at a lower price than local competitors.

As an Internet Banking Pioneer ( Gary Lewis Evans ), I formed the original Bank of Internet in 1994 when I was President of La Jolla Bank

Why Do I Prefer Non-Fungible Domain Names Over NFTs and Un-Stable Crypto Currency Like Bitcoin

at This Time?

Premium domain names bring authority, credibility, legitimacy, and in many cases are easy to remember and hard to forget. They will generate leads, enhance the brand and like real estate and classic art, appreciate in value as they protect against inflation. The right domain (s) will lead to increased sales, reduce the cost of customer acquisition and increase profitability. Domain names are digital real estate that have a global footprint. Generic domain names are the greatest way to accelerate traffic and sales for a web site. Notice that the graphic below doesn't include domains. Why? Domains are the most significant non-fungible digital asset because they can generate income. The market will recognize the value soon.

Domain names are the first step needed when establishing an online business or for targeting online sales. Owning the global generic name for a product or service is a rare benefit. The non-fungibility of a domain name is a great starting point for meeting trust and security needs. Many generic names are common names that are used routinely in daily language. I do not own crypto currency but if I lived in a country other than the USA I would. As a long-time collector that still owns my 1950s baseball cards, a collection of toy cars, a 57 Chevy and five John Lennon serigraphs, I have not seen an NFT that piqued my interest. I am not a good speculator or trader and that kept me out of Bitcoin. Having held some domain names for over 25 years the time is right for me to sell a few. I will sell or lease the domain or just the email rights. Any domain name can be branded but a unique generic domain name, or marketplace platform like we are selling is very powerful. The final and very significant benefit for domain name investing before use is the extremely low carry cost. Unlike raw land that has insurance, security costs and taxes, the only required annual cost for a domain is the registration fee of less than $25 for a .com at this time. A person can hold millions in domains and their is no personal or real estate Taxes. The Need For Blockchain Fungibility, Non-Fungibility Plus DeFi

We agree with PA consulting and their assessment of non-fungibility and Blockchain.

“ the characteristic of non-fungibility that’s key to enabling some of the most revolutionary and disruptive applications of Blockchain. Non-fungible tokens could be used in voting and elections to eliminate fraud and transform democracy. They can help organizations better know their customers through improved loyalty programs.” “For many businesses, it will be blockchain’s ability to process non-fungible tokens that will spur innovation rather than its use as a cryptocurrency.” From the perspective of merchant payments and consumer banking, banks have not kept up with market needs. In 1994 when I pioneered Internet banking as President of La Jolla Bank, Amazon launched as an online bookstore. At that time no one would have predicted that retail would outperform banking in the digital economy. Everyone was wrong.

Bankers are smart enough to have advanced aggressively into the digital economy, but they have not. The only logical reason for banking’s failure is regulation. Protecting high fees and using regulators to block competition is a close second. Are banks ready to compete and move out of regulatory protection?

“Steve Cocheo, Executive Editor at The Financial Brand states that

in the words of JPMorgan Chase Chairman and CEO Jamie Dimon the traditional banking industry faces a continuing significant challenge as a combination of fintech, big tech and shadow banking players continue to build market share under favorable regulatory conditions

Dimon says FinTechs, big techs and shadow banks aren't just nibbling at the fringes of the financial industry. The head of the largest U.S. bank says some are now gobbling up significant chunks of market share, threatening to render traditional institutions irrelevant.” The FinTech and banking opportunity could not be greater, and banks will benefit by working with FinTechs because they think outside of the regulatory constraints. Technology and cryptography are easy, the hard part is designing how to use the technology for business (The Model). The FinTech risk is that the new FinTech competitors get sloppy or embarrass the bank regulators, politicians or the CFPB. Banks can help reduce partner FinTechs risk. Distributed finance (DeFi) is current state of art in banking and finance. Crypto currency and in particular Ethereum is generally the focus for DeFi. Developers are true believers, focused on crypto currency and are experiencing the typical theft and losses of a new industry. I see the opportunity in stable value currency, Blockchain and centralized finance (CeFi).

The newest digital focus in digital assets is Non-Fungible Tokens (NFT). NFTs are built on Blockchain and includes cryptography features as well. The excitement in NFTs will lead to a greater appreciation for all non-fungible digital assets. Non-Fungible assets are not new, there is only one Mona Lisa and one North East corner of 57th and 5th avenue in NY. The value of the Mona Lisa is collector based; the value of commercial real estate is a function of the earning that can be generated from the location. There are fungible assets that have value as well. Gold in the physical world and Bitcoin in the digital world are two examples. Both Gold and Bitcoins have limited supply and are priced based upon supply and demand plus speculation. Non-Art Assets with limited or no income generation potential often relies on a “Bigger Fool” that will pay more to purchase the asset in the future. A unique non-fungible income producing asset will in most cases have the greatest value. What would the domain Amazon.com be worth? Tesla.com sold for $11,000,000, Voice.com sold for $30,000,000 and in March 2021, Angel.com sold for $2,000,000.

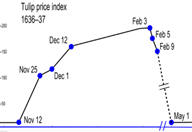

What if you were given the choice to magically own the Mona Lisa or the Domain name Amazon.com (Not the business)? You would magically own one or the other effective tomorrow. You could hang the Mona Lisa on the wall or sell it. The Amazon domain could be sold or you could create a lease (Digitlord) with Amazon. I would take Amazon.com over the Mona Lisa because it is a Non-Fungible branded domain that is income producing. Speculation Crypto currency and NFTs are real. Current speculation will impact credibility and adoption but in the long run the value will be assured. Historically we have had fungible assets that were thought to be unique or assets that had easy access to a greater supply that were mis-priced. One example would be the Dutch Tulipmania. “In 1636, according to an 1841 account by Scottish author Charles MacKay, the entirety of Dutch society went crazy over exotic tulips. As Mackay wrote in his wildly popular, Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, as prices rose, people got swept up in a speculative fever, spending a year’s salary on rare bulbs in hopes of reselling them for a profit.” Two Examples of Non-fungible Digital Assets

I admit that I do not understand the economics of this transaction.

"Until October 2020, the most Mike Winkelmann — the digital

artist known as Beeple — had ever sold a print for $100. I admit that I do not understand the economics of this transaction.

"Until October 2020, the most Mike Winkelmann — the digital

artist known as Beeple — had ever sold a print for $100."A Beeple NFT of his work sold for $69 million at Christie’s. The sale positions him “among the top three most valuable living artists,” according to the auction house.

As a start-up that paid $30,000,000 for the domain name (Voice.com) I expect the company to be the leader in NFTs and social networking by focusing on voice. Unlike my valuation concern with the NFT above, I understand the Voice.com purchase and valuation. Voice wants to be the go to social network app by focusing on Voice. Voice.com is a one of a kind generic domain name, Easy to remember and hard to forget. I read that the seller didn't want to sell and bidding started at $150,000.As reported by Voice "One year ago, Voice embarked on an ambitious mission: to build social as it should be.""This summer, Voice will upgrade, becoming a social platform where users can create digital arts across all formats — visual, written, audio and video — enabling them to be easily bought and sold as unique digital artifacts (NFTs).

Support Data

|